Homeownership within the Tx not just brings a destination to call house but even offers a chance to generate guarantee. When you’re a homeowner trying to leverage the newest collateral you oriented, House Collateral Fund (The guy Loans) and House Security Credit lines (HELOCs) is actually effective monetary gadgets to consider. Within this publication, we shall talk about the latest particulars of The guy Money and you can HELOCs, delivering insights getting Colorado citizens interested in unlocking the benefits for the their homes.

Information Household Collateral

Domestic security try an effective homeowner’s need for their residence, representing the difference between the fresh house’s market price together with outstanding home loan balance. Within the Texas, in which assets viewpoints may experience fluctuations, skills and you may leverage it security is paramount to and then make advised financial conclusion.

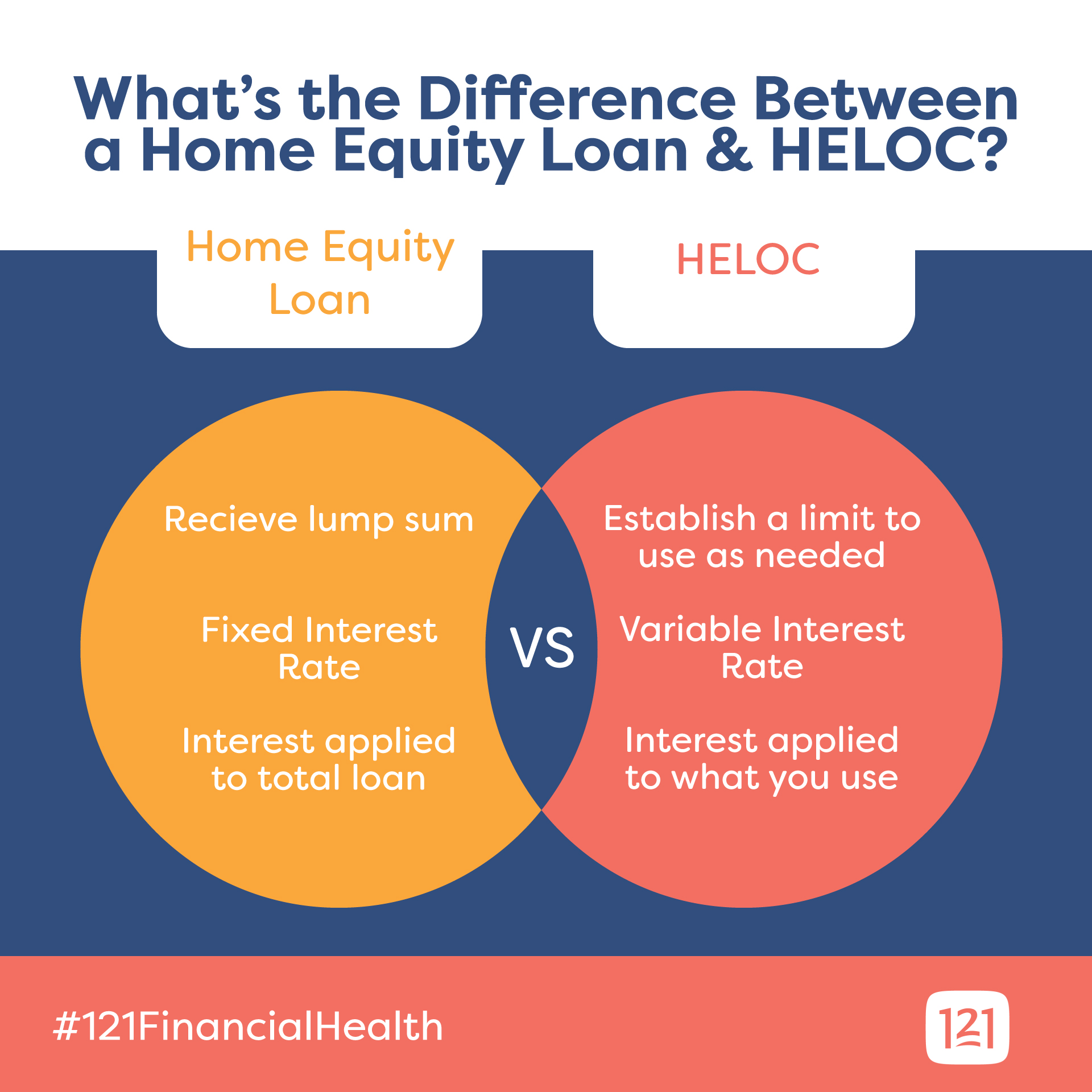

In terms of accessing family collateral, a few number 1 choices are Family Guarantee Fund (The guy Loans) and you will Household Equity Credit lines (HELOCs). The guy Funds offer a lump sum payment amount which have a predetermined notice price, leading them to ideal for structured costs particularly domestic renovations. While doing so, HELOCs give a rotating credit line, offering flexibility having ongoing requires for example studies expenditures otherwise unforeseen will set you back. Tx property owners is cautiously imagine its monetary requirements before you choose between these alternatives.

Qualification Requirements for He Financing and you will HELOCs for the Texas

To help you qualify for He Loans otherwise HELOCs in Tx residents generally speaking you want a robust credit score, a reasonable debt-to-income ratio, and you may a sufficient amount of collateral in their home. Regional loan providers, like those to your Morty’s platform, also have personalized recommendations based on individual monetary points and also the novel areas of the fresh Texas market.

Just how to Get The guy Fund and you can HELOCs

The applying techniques to have He Fund and you can HELOCs concerns meeting paperwork, including proof income and you may property valuation. Tx owners can benefit out of dealing with local mortgage officers just who see the subtleties of your own state’s housing market. Morty, an internet home loan brokerage, links borrowers which have regional financing officers, guaranteeing a customized and you may effective app procedure. Having Morty, home owners could even sense a quick closing, to the possibility to romantic towards an excellent HELOC during the as little as the 14 days.

Determining Mortgage Quantity and you can Rates

The mortgage number and you will rates of interest to have He Funds and you will http://paydayloancolorado.net/burlington HELOCs believe some situations, such as the level of equity, creditworthiness, and you may industry conditions. Texas homeowners may benefit regarding the aggressive cost provided by local lenders, especially when making use of on the internet systems including Morty you to improve the credit techniques.

Prominent Purposes for The guy Money and you may HELOCs

Colorado property owners often explore The guy Fund or HELOCs for various motives. They may boost their house inside portion including Denver’s LoDo, Texas Springs’s Old North end, otherwise Boulder’s Pearl Road Mall, improving property value. They might and additionally combine debts so you’re able to clear up finances or protection significant expenses such university charges otherwise scientific expenses. Some property owners within the Texas actually put money into local rental services in the components such Fort Collins otherwise Aurora to increase their earnings. With sensible prices and versatile words, these types of finance help Colorado home owners visited its monetary goals and you may bundle money for hard times.

Considerations

As he Finance and you will HELOCs promote tall experts, its crucial for home owners to be familiar with perils. In charge fool around with is vital, and knowing the terminology, prospective alterations in interest rates, in addition to likelihood of property foreclosure in case there is fee standard are important. Regional mortgage officers, obtainable as a result of Morty, provide strategies for in charge borrowing.

Unlocking house security owing to The guy Funds or HELOCs inside the Colorado requires consideration and told choice-and then make. By understanding the differences when considering such possibilities, consulting with local mortgage officials, and making use of on the web programs eg Morty, people can be influence the collateral to achieve the monetary desires responsibly. Consider, the main should be to line-up these types of economic devices along with your book items and desires.

If you wish to become produced to help you a region loan administrator towards you, manage a merchant account to the Morty now! Zero tension, free of charge, just higher local assistance and you will support!